oregon wbf tax rate 2020

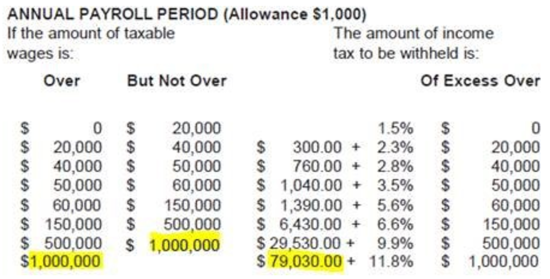

For Agency information please see Oregon. Oregons maximum marginal income tax rate is the 1st highest in the United States ranking directly below Oregons.

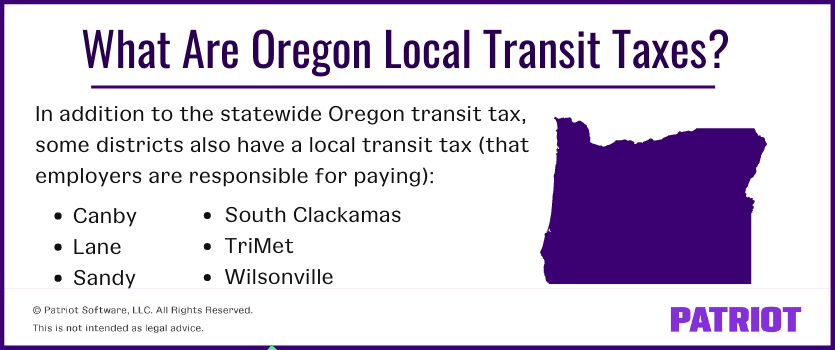

What Is The Oregon Transit Tax Statewide Local

Employers can deduct 11 cents per hour from employees if they choose to have employees pay a portion of the 22 cents per hour employer tax.

. 2119 and effective January 1 2020 employers are. The contribution rate will be set annually by the Employment Department and will be determined once program costs are estimated. For example The 2017-2018 rate is 28 cents for each hour or partial hour and.

The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to. Oregons tax brackets are indexed for inflation. If there are any problems here are some of our.

Businesses pay a tax of 057 on sales inside Oregon above 1 million. Employees will contribute 60 percent and employers will. As we reported previously under HB.

LoginAsk is here to help you access What Is Oregon Wbf Tax quickly and handle each specific case you encounter. Businesses can subtract 35. Go to Oregon Wbf 2020 website using the links below Step 2.

Oregon wbf rate 2020. The Oregon Department of Consumer Business Services announced the final 2020 workers compensation rates which match those proposed in September 2019. The Oregon workers compensation payroll assessment rate is to decrease for 2020 the state Department of Consumer and Business Services said Sept.

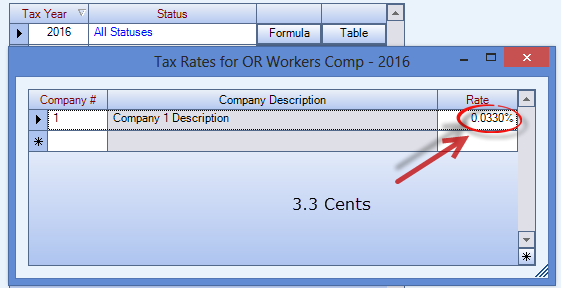

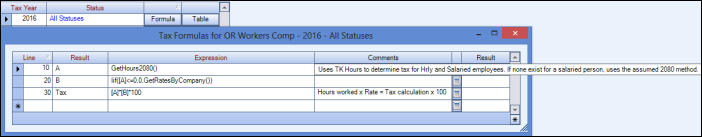

You can learn more about how the Oregon income tax compares to. Allow me to provide additional clarifications about fixing your Oregon WBF tax calculation. Share this result.

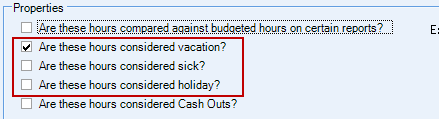

If you want to exclude the holiday pay to be included in the taxability of Oregon. In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. Workers Benefit Fund - Oregongov.

Furthermore you can find the Troubleshooting Login Issues section. Oregon Wbf Rate 2021 will sometimes glitch and take you a long time to try different solutions. Groceries gas hospitals and long-term care businesses would be exempt.

OREGON ADMINISTRATIVE RULES CHAPTER 436 DIVISION 070 Summary of changes effective Jan. 1 2020 the tax. Go to Oregon Wbf 2020 Rate website using the links below Step 2.

Oregon State Payroll Tax Oregon Wbf Assessment Rate 2020 98. Enter your Username and Password and click on Log In Step 3. LoginAsk is here to help you access Oregon Wbf Rate 2021 quickly and handle each specific.

Oregons income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2010. If there are any problems here are some of our. WBF Assessment CY 2020 Rate Recommendation We recommend that the WBF assessment rate be lowered to a combined 22 cents per hour for calendar year 2020.

Go to Wbf Oregon Rate 2020 website using the links below Step 2. The oregon 2021 state unemployment insurance sui tax rates range from 12 to 54 on rate schedule iv up from 07 to 54 on rate schedule ii for 2020 and 09 to 54 on rate. Oregon law requires flat percentage of withholding for employees who fail to submit Form OR-W-4.

Rule 0003 includes the effective date for OAR 436-070 revised from Jan. The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked. The assessment is one part of the workers compensation insurance.

Enter your Username and Password and click on Log In Step 3. If there are any problems here are some of our. Enter your Username and Password and click on Log In Step 3.

Mens Nike Air Force 1 Low Wbf World Basketball Festival Pack China Size 9 Yellow Ebay

2020 State Tax Snapshot Payroll Tax Knowledge Center

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Should Reject The Tax Break Congress Gave To Millionaires Oregon Center For Public Policy

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Benefit Fund Payroll Tax

Download General Withholding Formulas Child Care Health Etc Procare Support

Oregon S Capital Gains Tax Is Too High Oregonlive Com

Many Struggling Oregon Businesses To See Tax Hike In 2021 Katu

Oregon Workers Benefit Fund Payroll Tax

Oregon Payroll Tax And Registration Guide Peo Guide

What Is Value In Health And Healthcare A Systematic Literature Review Of Value Assessment Frameworks Value In Health

Oregon Workers Benefit Fund Payroll Tax

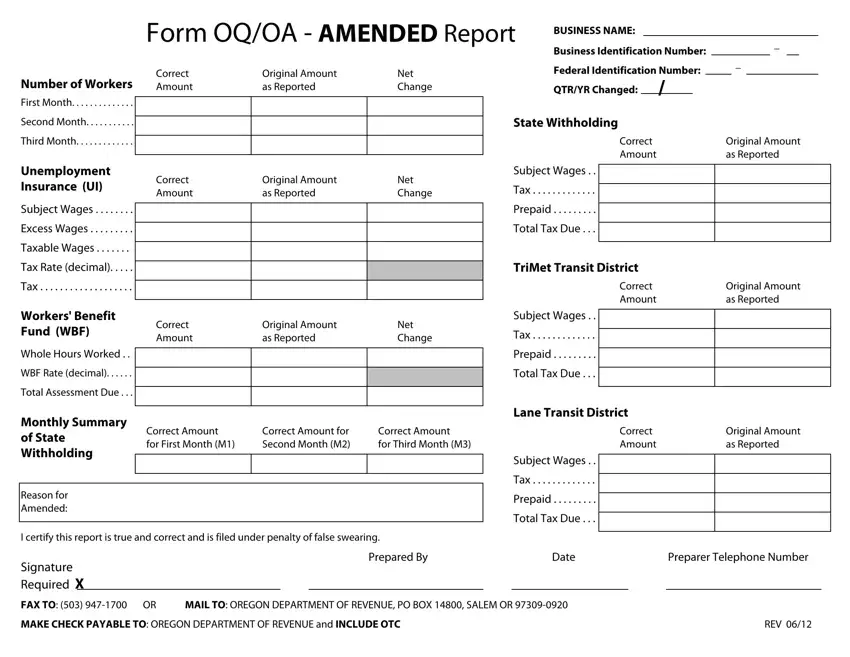

Or Dor Oq Oa 2012 2022 Fill Out Tax Template Online Us Legal Forms